Discover more from Consumer/Culture/Commerce

Toymaker Mattel (MAT) has been a pretty terrible stock for the last 10 years. It currently sits around $21, less than half of its 10-year high just shy of $48, which was set back in late 2013. The current quote nevertheless represents a bit of a comeback – since MAT shares spent much of 2018 through 2020 below $15.

Mattel, like many toymakers, got a big boost during the pandemic. With schools, camps, and extracurricular activities shut down for much of 2020 and the early part of 2021, parents armed with stimulus checks and desperate to entertain their children at home splurged on toys. After suffering six straight years of negative sales growth from 2014 to 2019, Mattel eked out a modest topline gain of 2% in 2020 and followed it up with a banner year of 19% growth in 2021.

Mattel had suffered many company-specific headwinds to growth in the years leading up to the pandemic… among them, the loss of the Disney Princess doll license to competitor Hasbro (HAS), which Mattel later spent a pretty penny to get back. Other product-specific growth headwinds included the atrophying of the once mighty American Girl doll franchise, which was under assault from much lower-priced copycat competitors, and a flailing Fisher-Price preschool division.

Over at Barbie, there was inconsistent and sometimes even falling demand. Barbie had to contend with competition from sassier, more modern L.O.L. Surprise! dolls, echoing the market share losses that the Barbie line had suffered at the hands of the upstart Bratz line over a decade earlier. Barbie – the world’s biggest doll brand – has also off-and-on been under assault for the narrow image of beauty conveyed by the flagship Barbie doll, which is impossibly tall, slender, and blonde.

Product line-specific challenges had rendered Mattel a market share loser in the years leading up to the pandemic… but the surge in demand for toys combined with resurgent popularity for Barbie got Mattel out of its rut in 2020-2021.

But in 2022, with overall toy demand normalizing to pre-pandemic levels, growth at Mattel flatlined again. Despite the temporary pandemic-related reprieve, the secular headwinds to Mattel and all toymakers came back into focus.

Kids, They Grow Up Too Fast

That sentiment may be a common wistful lament of parents of school age children, but it’s also a complaint likely to be heard echoing in the halls and board rooms of major toy companies. While the Boomers and Gen X among us might remember playing with toys well into our tweens or even early teens, these days, the lifecycle of kids as avid consumers of toys tends to peak around 8 years old, with demand falling off rapidly thereafter.

All the way back in 2002, the Washington Post wrote in an article about age compression:

Got some headless Barbies lying abandoned in the bottom of the family toybox? Feeling puzzled, Boomer Mom, by your child's lack of reverence for the 1960s icon you adored?

It turns out that American kids are abandoning not just Barbie, but also most other traditional toys, at ever-younger ages.

Used to be, for instance, that girls in Andrea's age range, 6 to 10, were the prime market for Barbie and other dress-up dolls. But nowadays, Barbie is really big only with 3-to-5-year-olds. After that, she's considered pretty babyish.

The article titled, “Toys? But I’m 10 Now!” mentioned that tweens (kids 8 to 12) were turning away from toys and focusing on the three Ms: “movies, music, and the microchip.” I might add a fourth M: makeup.

Here, the microchip refers to the rise of the video game industry… Written in 2002, it would be two more years before tween favorite Roblox (RBLX) would be founded (2004), seven years before another tween favorite Minecraft would be made public (2009), and 15 years until the launch of the Nintendo (NTDOY) Switch (2017).

Alphabet’s (GOOGL) YouTube, Netflix’s (NFLX) streaming service, and TikTok were also years away from launch back then. Suffice to say that competition for young hearts and minds has only gotten worse since this 2002 article.

Once upon a time, kids used to be good customers for toys through their middle school years, but now the window to market traditional toys to them often ends before grade school does.

The secular headwind of age compression and the rise of e-commerce were two of the primary reasons for the bankruptcy and subsequent liquidation of Toys R Us.

Pour One Out for Geoffrey the Giraffe, There are No More Toys R Us Kids

Without Toys R Us, toy makers no longer have a giant customer that is deeply committed to the toy business 365 days a year. Now, Mattel, Hasbro, and others need to move more merchandise through general retailers like Walmart (WMT) and Target (TGT), which tend to flex up the space devoted to toys in the fourth quarter prior to the holidays, only to rapidly remove the extra space when the holidays are over.

When the square footage dedicated to toys shrinks back to its normal size in January, these retailers are quick to slash prices to dump leftover inventory and clear up space. Then they turn to companies like Mattel and ask for rebates and future discounts, to get their margin in the toy department up to plan, even in the wake of aggressive discounts.

Of course, when Toys R Us was around, it could take its time with working down these inventories – since it was always committed 100% to the business of selling toys. Fewer fire sales meant less need for Mattel and Hasbro to provide vendor support on product misfires, which there will always be, since the toy business is hit-driven and inherently unpredictable.

Seeing so much of the business move online to Amazon (AMZN), Walmart.com, and Target.com brought additional problems for the toy companies. First, selling on the Internet led to greater price transparency and more discounting. Additionally, while customers used to discover products while walking the aisles of Toys R Us or mom-and-pop toy stores (also a dying breed), now it’s much harder for those products to get discovered, since search and recommendation algorithms on Amazon and elsewhere tend to serve up the most popular items on page one results, making it harder for the “long tail” of items beyond the top-sellers to get discovered.

Hasbro Looked to Hollywood as a Way Through Secular Challenges

Hasbro not only leaned hard into its master licenses for Disney’s (DIS) Marvel, Star Wars, and Princesses franchises, but it invested in turning toy properties into entertainment properties. At this point, it may be hard for many people under 30 to even remember that before it was a movie franchise, Transformers were a toy line.

Using the success of Transformers as a blueprint, Hasbro tried – with varying results – to replicate the “toys as entertainment IP” franchise enhancement strategy, with films based on G.I. Joe figures and the board game Battleship. My Little Pony figurines spawned both films and a Netflix series. Just this year, Hasbro, in partnership with Paramount (PARA), presented a movie based on its storied Dungeons and Dragons game.

This strategy worked well for Hasbro, and from 2010-2019, HAS shares not only outperformed the S&P 500, but they walloped MAT shares. HAS shares had a total return of 337% from 2010-2019, while MAT shares returned -6%!

Hasbro’s success didn’t go unnoticed by the Mattel board, and in 2018 they brought in a new CEO, Ynon Kreiz, an executive with a background in entertainment, not toys. Kreiz had been the CEO of Maker Studios at the time of its 2014 acquisition by Disney. Prior to that, he had led Fox Kids Europe.

Kreiz came onboard with a strategy that very much mirrored Hasbro’s entertainment IP strategy, where movies and TV shows were made to bolster the popularity and cultural relevance of its toy franchises, supporting continued consumer relevance and sales growth.

In 2019, Kreiz announced the first project in Mattel’s new entertainment IP strategy would be a Barbie movie, starring Margot Robbie, which would be produced in partnership with Warner Bros (WBD).

Come On, Barbie, Let’s Go Party

It’s been five years since Kreiz took the reigns at Mattel and four years that investors have been hearing about the big splash Mattel believed Barbie would make at movie theaters.

Now the moment is finally here… it’s Barbie’s opening weekend.

And it’s a phenomenon.

If you’ve been anywhere on the internet in the last two weeks, you’ve probably heard of Barbenheimer… the unlikely double feature of Barbie and this weekend’s other big film release, Oppenheimer, the biopic about the inventor of the atomic bomb, the latest creation from revered writer-director Christopher Nolan.

A picture is worth a thousand words, and just the outfits and expressions in the pics below are enough to explain just how weird this mash-up is.

Source: Yahoo Entertainment

As silly and unexpected as it sounds, Barbenheimer is a thing… a really big thing. An estimated 200,000 people have bought advance tickets to see both movies on the same day. And the fan art has been off the charts:

It’s hard to know if Barbenheimer was planted by one astute professional viral marketer, or if this is truly an organic eruption of the zeitgeist.

What is certain is that the traditional marketing execution around this Barbie film has been flawless. Whether it is emanating from the marketing department at Warner Bros Discovery, the marketing department at Mattel, or some agency employed by one or both of these corporations… give whoever is responsible an A+ for an incredible teaser, an even better trailer, Margot Robbie’s epic pink wardrobe on the film’s press tour (at least until it was interrupted by the SAG-AFTRA strike), and for the tie-ins and collabs.

Imagination, Life (and Products) Are Your Creation

It’s hard to think of any movie or TV show that has inspired the range of collaborations and product tie-ins that Barbie has.

Barbie is of course a fashionista, so it should be no surprise that the list of fashion companies collaborating with hot pink products to celebrate the movie’s release is long. It includes specialty retailers Gap (GPS), PacSun, and Rue21, U.K. fast fashion retailer Primark (ABF LN), Italian athletic footwear maker Superga (BAN IM), U.K. e-commerce site Boohoo (BOO LN), shoe chain Aldo, jewelery maker Kendra Scott, fast fashion giant Zara (ITX SM), intimates maker MeUndies, and footwear maker Crocs (CROX).

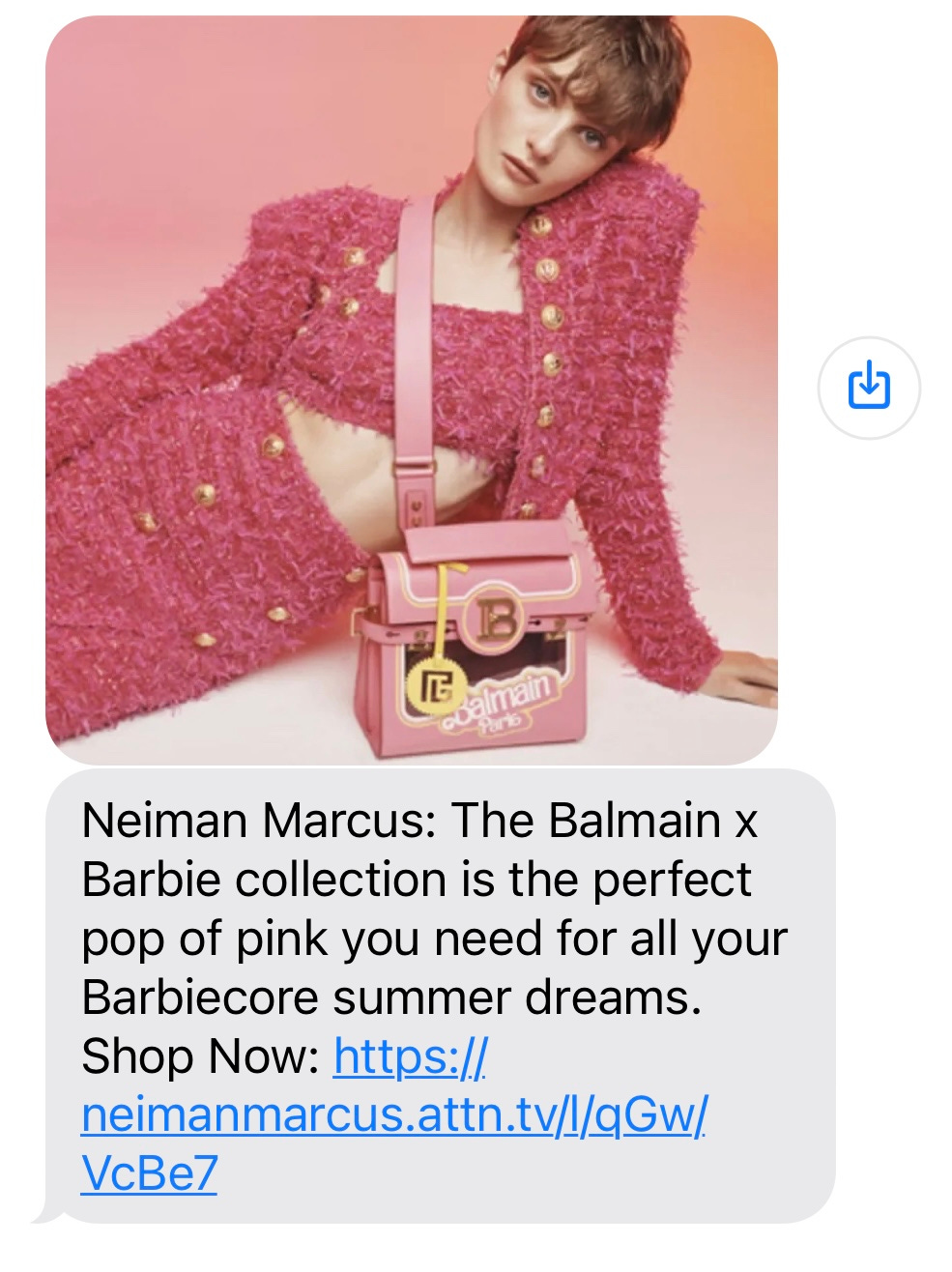

Even luxury is getting into the act… I was shocked to get this marketing text from luxury department store Neiman Marcus yesterday, advertising the Balmain X Barbie collection….

For the curious, the outfit in the picture from French fashion house Balmain will set you back a cool $6450 (before tax!) and the handbag is a relative bargain at just $2450. I think I will stick to the Gap or Zara for all my emergent hot pink clothing needs….

But the collabs don’t stop there. If you are looking to get your own DreamHouse up to snuff… how about a Barbie rug from Ruggable?

You can get Barbie luggage, Barbie roller skates, Barbie makeup… and somewhat ironically, Barbie ice cream at Cold Stone Creamery (Barbie doesn’t look like she eats much ice cream) or a Barbie-themed Xbox (ironic only because if we didn’t have videogames, Mattel might not have had to try so hard to juice up this 64-year-old doll franchise in the first place).

Source: news.xobox.com

And I will admit it… even I succumbed to the temptation of ridiculously excellent brand marketing. Here’s Simba, the most Barbie-like of my three dogs enjoying the Barbie X FUNBOY Golf Cart pool float.

All these product tie-ins are an exercise in capitalism on steroids and they are probably earning Mattel some nice royalty cash and even more importantly, have propelled Barbie to the top of the collective consciousness. And that is likely going to pay off big time at the box office.

Just a few weeks ago, Barbie was expected to open at $65-$85 million. Expectations are now revised upward with box office pundits expecting the film to register $110+ million in domestic box office this weekend. And expectations for total domestic box office have gone parabolic on fan prediction site hsx.com.

Source: hsx.com

Barbie-mania is Real, But Can Barbie’s Pink Power Spur a Sustainable Turnaround at Mattel?

Mattel reports earnings next Wednesday. It had previously reiterated its 2023 guidance for flat sales and earnings per share (EPS) of $1.10 to $1.20, down slightly from 2022’s $1.25 in EPS, with modest gross margin expansion expected to be offset by higher operating expenses. The company is calling for toy industry growth but expects destocking to be a 3%-4% headwind to topline growth, as retailers work through excess inventory.

I wouldn’t be shocked to see Mattel increase its guidance for full year revenues and EPS when it reports on Wednesday. The last comments about guidance came before Barbie-mania took hold, and since early June, The Little Mermaid live action remake movie, for which Mattel has the toy licenses, has done better than its opening weekend in late May suggested it would. If popularity at the box office translates to popularity on the toy list – which it often does – Mattel may do a little better than previously guided. 2023 earnings of $1.25-$1.30 wouldn’t shock me when the dust settles.

But even if earnings upside materializes, it’s not in the bag that MAT shares go up. MAT shares are up 22% since the beginning of June, before the Barbie hype fest went into overdrive. Even if Barbie can drive EPS to $1.30 this year, that’s still only 18% higher than the low end of previous guidance.

I would expect that Barbie-mania is likely already priced into the stock here, and the movie could ultimately become a “sell the news” event. And it’s important to remember that this time last year, expectations were for Mattel to earn $1.94 in 2023… so this company is very much still in comeback mode.

It's also important to note that the box office champ of 2023 so far is The Super Mario Bros. Movie, which greatly outperformed expectations and racked up $574 million at the domestic box office and $1.3 billion worldwide. Meanwhile, shares of Nintendo, which owns the Super Mario Bros. IP, are up only 9% this year.

Drawing a straight line from a cultural phenomenon to a stock that will make you money isn’t always straightforward.

The bigger question here is not what Barbie the movie does for Mattel’s Barbie line sales this year, but what the film means for the long-term earnings power of the company. For Barbie to be a gamechanger, you need to believe one of two things:

1. The growth of Barbie products and licenses will be permanently higher because of this movie and its potential sequels.

2. The Mattel portfolio is ripe with IP that can be exploited into movies and TV shows that reinvigorate sales and licenses across many brands.

I have trouble betting on Point #1. The age compression issue with girls is severe – the window is very short now for dolls, and privately held MGA Entertainment, maker of both Bratz and L.O.L. Surprise! dolls has proven a scrappy and creative competitor, that periodically comes up with innovations that take a chunk out of the Barbie franchise. Also, as beauty standards shift and parents of young girls increasingly worry more about eating disorders (a scourge that is sadly on the rise), enthusiasm for Barbie and the very narrow model of beauty that she represents may wane… although I do give props to Mattel for trying to modernize Barbie, by introducing dolls with different ethnicities and a wider range of body types.

I do think we will see a surge in Barbie demand in 2023 and 2024… but I am just not sure it will have legs longer than that. Another thing to worry about with Barbie is that the film’s feminist vibes and the presence of a Trans Barbie has begun to attract the ire of conservative news programs and podcasts… so as much as the film may build up interest in one segment of the population, it might alienate other large swaths of consumers.

If I am wrong, and the Barbie demand surge has legs as long as the doll’s, then MAT shares are probably a buy, since the line accounts for about one-third of Mattel’s $5.2 billion in annual revenue.

As for Barbie being the beginning of something bigger… it’s possible, but I am dubious.

Barbie was the best brand within the Mattel portfolio to exploit into a movie. She’s iconic. She’s glamorous. She’s a human figure, making her a natural protagonist.

When you look at the next biggest brand in the portfolio, there’s Hot Wheels, which has a film in development under power producer J.J. Abrams, of Lost, Star Trek, and Star Wars: Episode VII fame. There’s reason to be optimistic there.

Other projects in the pipeline include films based on Polly Pocket, Rock ‘Em Sock ‘Em Robots, and Major Matt Mason – a toy line I had never even heard of, since it was discontinued in the mid-1970s. Even with A-List talent like Tom Hanks and Vin Diesel attached to these films… it’s a big drop off in brand appeal once you get past Barbie and Hot Wheels.

It's also important to remember that this entertainment strategy worked well for Hasbro… until it didn’t, and now Hasbro is struggling. The entertainment business is even more unpredictable and volatile than the toy business, and cold streaks are real.

MAT shares are trading at around 10x earnings before interest, taxes, depreciation, and amortization (EBITDA) and at a price to earnings ratio (P/E) of 18.5. They aren’t super expensive, given the strong brands, but they aren’t cheap either, especially when you think about how revenues in 2023 will be 15-20% lower at Mattel than they were in 2013, thanks to all those company-specific and secular issues discussed above.

There may be some small money to be made on earnings revisions upward should the Barbie bump last 4 to 6 quarters as opposed to just 1 to 2. But I don’t see big earnings growth or a re-rating of this stock to trade at higher multiples happening unless growth meaningfully – and sustainably – picks up, which is going to be hard to do with the multiple secular headwinds of age compression, videogames, TikTok, streaming media, and a concentrated and powerful set of distribution partners in both physical retail and e-commerce.

I’m taking a pass on buying MAT shares… but I will enthusiastically buy a ticket to Barbie.

Some Interesting Things I Read (or Watched!) the Last Two Weeks

Variety, 7/20/2023

If you’re not Barbie’d out by now, more on the property’s 10+ year journey from concept to theaters.

Hollywood Studios’ WGA Strike Endgame Is To Let Writers Go Broke Before Resuming Talks In Fall

Deadline, 7/11/2023

The article that everyone in Hollywood was talking about last week. Everyone wants to know who the anonymously quoted studio executive is – and if this person is even real, or just a fabrication. If you read this one pull quote, you will understand why:

“The endgame is to allow things to drag on until union members start losing their apartments and losing their houses,” a studio executive told Deadline.

AI Doomsday Scenarios Are Gaining Traction in Silicon Valley

Bloomberg, 7/13/2023

Not one to read right before bed.

“Barbie Girl” Music Video by Aqua

YouTube

If you thought the title and some of the subtitles of this essay were odd, you somehow must have missed this iconic 1997 tune from Danish-Norwegian pop group Aqua.

Prosperous Investing!

Disclaimer: This content is for informational and educational purposes only and does not constitute financial advice or a recommendation for a particular investment.

Disclosure: The author may have a personal financial interest in the securities mentioned. At the time of publication, personal investments included RBLX, GOOGL, NFLX, DIS, and CROX.

Subscribe to Consumer/Culture/Commerce

Equally Opportunistic Investing